As a small business owner in India, do I have to submit regular GST returns? Yes, but foremost you have to get GST registration. You have to file GST returns as per the prescribed regulations by the Government of India. At times, incorrect GST Return entries, results in rejection of the input tax credit, in addition with penalties.

As a small business owner in India, do I have to submit regular GST returns? Yes, but foremost you have to get GST registration. You have to file GST returns as per the prescribed regulations by the Government of India. At times, incorrect GST Return entries, results in rejection of the input tax credit, in addition with penalties.

In India, Filing GST Return is necessary for every business owner. The legal document follows the rules under the GST Act/guidelines. GST Return Filing is very important as it creates a link between the government and the taxpayer.

Income Tax authorities of India allow business owners to file monthly/quarterly GST returns. While filing the GST Return, the taxpayer provides detailed information regarding the business activity, payment of taxes, disclosure of tax liability, details of inward supply and outward supplies, etc.

Why is GST Return essential in India?

GST ensures that taxpayer services such as registration, returns, and even compliance are clear-cut and straightforward. Hence, it allows total transparency to all. Every small or large business owners have to submit monthly returns.

An e-commerce operator provides the details of the sales and purchases of goods and services. The information also includes the tax paid and collected. Nowadays, online filing of return has reduced the manual work. The GST council has constructed a complete transparent Income Tax system.

In today’s time, GST Return filing is quickly done through online services. One can look for a lot of information regarding the GST rules on social media.

How it is beneficial in the long term

In present times the implementation of GST is the biggest tax reform that has taken place in India. Due to which many benefits have taken place.

- All businesses have to report each transaction, hence no circulation of black money.

- A standard Invoice format is available for both sellers and recipients.

- All the invoices are centrally stored, so every taxpayer has its own collated data.

- No unnecessary taxes.

- One tax structure followed by the whole nation.

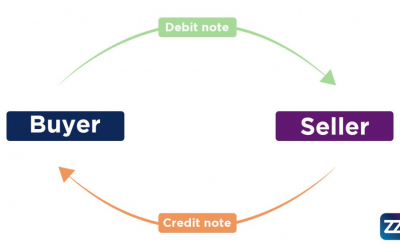

It is mandatory to file proper information in the returns. The effective procedure creates a smooth flow of credit until the last receiver.

So to make it is easy to understand, the returns designed are in sync with each other for all the transactions. Due to which no sale is left unattended between the buyer and the seller while submitting the final return. Imprezz services offer ready to use GST invoice solution for all its customers.

Various kinds of GST Return forms

Different forms are available to file GST returns. The online submission of GST Return Filing, i.e., on the GST portal. Nonetheless, if you want, you can also file GST returns filing manually. The forms are submitted depending on the type of transaction and registration of the taxpayer.

Offline returns are easy to upload later on the GSTIN portal. It can be done either by the taxpayer or handled by a chartered accountant.

Do checkout www.imprezz.in to create an efficient work environment, with quick clicks.

Note:- Tax return data gets saved in GSTN. The data is readily available on the online platform for all the users and taxpayers for every tax period.

What is GSTN, GSTIN & ISD

GSTN The Goods and Service Tax Network is mainly an organization that manages the entire IT system of the GST portal. With this, the Government of India tracks every financial activity. It also helps in providing taxpayers with all services such as registration to filing and maintaining all tax details.

GSTIN is a unique Goods and Services Tax Identification Number given to all businesses that fall under tax management. Every taxpayer is assigned a state-wise PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN). So, GSTIN is a tax registration number under GST.

ISD (Input Service Distributor) is a facility for businesses to share common expenditures and billing/payment via a centralized location. It is helpful in simplifying the credit taking process and increases the seamless flow of credit under GST.

Note:- GSTIN and registering for GST, both services are free of cost.

GST Return form for small business owners

Yes, all small business owners have to submit GST returns. According to the Indian govt GST rules, small businesses can file their returns online through Forms ITR-3 or ITR-4. The offline or manual filling is only allowed for certain taxpayers. For example, individuals with income less than Rs 5 lakhs and super senior citizens who are above 80 years of age.

The efficient financial tools at Imprezz are user friendly and specially created to help small business and startup owners. Our GST Export tool assists you to export a GST income file. It helps to file your GST returns.

Note:-GSTR-2A is an auto-populated return form. It contains details of the input tax credit on purchases, TCS credits, and TDS credits of a buyer. The seller uploads the invoices when filing his GST Return.

Three ways of filing online Income Tax Return

- Online GST returns filing under digital signature.

- Transmitting the data through an electronic medium. The data is easy to re-verify if required.

- Data transfer through electronic medium and later submit a physical copy of ITR-V form.

Note:- Income tax returns should get verified within 120 days of online filing.

Necessary to file GST Return on time

Under GST, Return filing is very important. One must file a Nil return in case no transaction takes place. Till you don’t file the quarterly return for past months, filing a return for the present month is not allowed. Monthly GST Returns have to be submitted timely and regularly.

Delay in filing GST Return, makes you liable to pay additional interest and a late fee.

Imprezz software solutions offer you up-to-date reminders to avoid any payment delays.

How timely GST Return is beneficial for small business

With opting presumptive schemes, a small business administration with a turnover of less than Rs 2 crores, avails several benefits. One should pay the taxes and file tax returns timely and correctly. Hence it further helps in tax benefits and cash flow.

Small businesses do not pay Advance Tax four times a year. Instead, you can pay the entire amount in one go by the 31st March of the relevant financial year. They also get relief from the account books audit.

Note:- Composition Scheme, a simple and easy scheme for small taxpayers. The scheme comes under GST for taxpayers. It reduces tedious GST formalities and pays GST at a fixed rate of turnover. It is ideal for any taxpayer whose turnover exceeds is less than a crore.

Conclusion

Meaningful steps taken by the Indian government for GST return filing has provided an efficient and hassle-free process. The advanced technology and the latest software solutions have made tax filing with GST more rewarding for small businesses.

Imprezz software tool with secure solutions has simplified the calculating and filing tax returns with GST. Due to which small and medium businesses can easily create a day to day tax payable invoices within no time. The easy solutions available at Imprezz helps to modernize financial operations for every small business owner. To understand the various other services offered by us, do visit our website, www.imprezz.in.