Maintaining legally compliant, professional invoices is imperative to the operations of any business. But once you have created an invoice, it may not be the final one as there can be several changes due to various reasons in a single transaction.

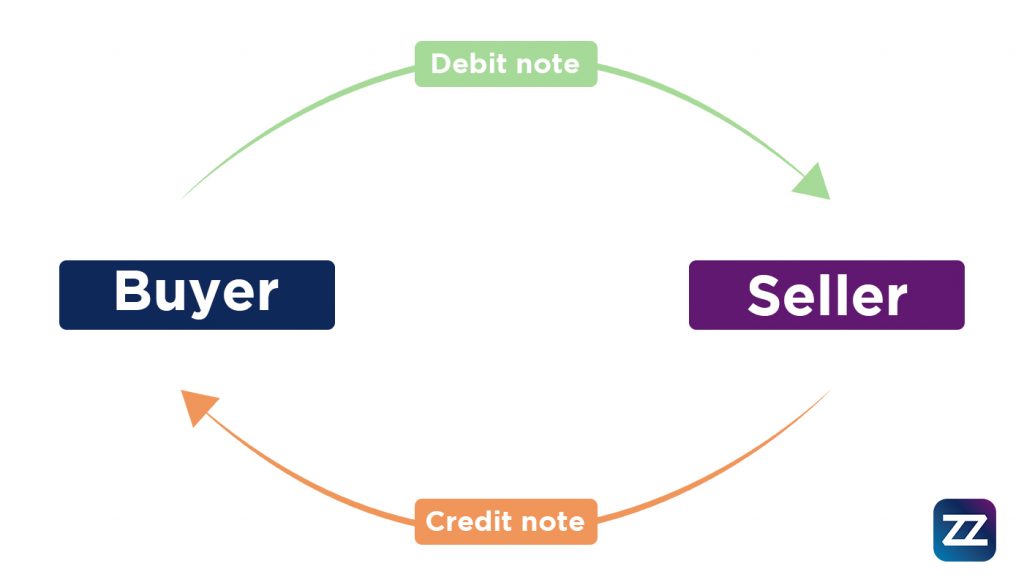

Is it possible to edit the invoice n-number of times as and when there’s a change? What is the ideal solution to this predicament? The answer is debit notes and credit notes.

Debit Note and Credit Note: When are these Issued?

Debit Note

Debit Note

A debit note or a debit memo is a document sent by the buyer to the seller for processing a request to return the funds under special circumstances. A debit note has to be issued before a credit note is issued by the supplier and stands for a formal request from the buyer to issue a credit note.

The buyer can be requesting a partial or full refund of the payment through a debit note under the following circumstances:

- When the supplied goods do not match up to the expected standards of the buyer

- When the goods delivered are not in proper condition — they are damaged or expired, or unfit for use/ sale to the end customer

- Incorrect billing/ miscalculation

- Cancellation of services or product purchase

- When the tax amount or GST is charged at a higher rate than the current applicable rates on the specific products or services at a particular time

All of the reasons mentioned above are valid grounds on which a buyer can send a debit note to the seller for a full or partial refund. The debit note is proof of the purchase return in the buyer’s accounting books.

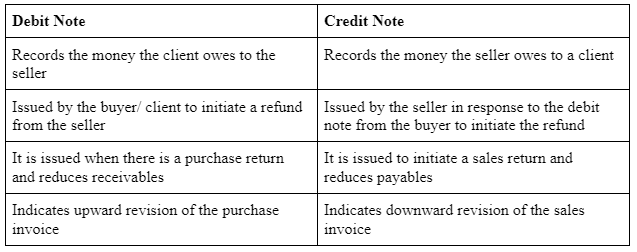

The debit note denotes the upward revision of prices in an already furnished invoice and also records any future liability that they may have to pay for. It also indicates a change in the taxable value of goods indicated in a tax invoice in case of a revision of taxes.

Credit Note

A credit note or credit memo is a document issued by the seller to indicate a full or partial refund to the buyer. It follows the issuance of a debit note from the buyer. This refund note is issued under the following circumstances:

- Suppose the supplier/ seller has supplied goods or services, not to the satisfaction of the consumer/ buyer in terms of quality or condition. In that case, the buyer might claim a refund by issuing a debit note. In response to the buyer’s debit note, the seller might initiate the refund by issuing a credit note against the existing purchase invoice.

- To initiate a refund due to a miscalculation by the seller in the purchase invoice.

- Revision/ correction of the discount percentage

- Cancellation of order/ pending payments against the initial purchase invoice

- When the tax amount or GST is charged at a rate higher than the applicable rate on specific products or services at a particular time

There are two types of credit notes:

- Credit notes on outgoing payments

- Credit notes on incoming payments

Multiple credit notes can be issued against one purchase invoice, as long as it does not exceed the total amount in the invoice. The credit note issued by the seller to the buyer acts as an indicator of the credit transfer into the buyer’s account.

Credit notes may reflect badly on the accounting history of the seller.

Debit Note and Credit Note: Differences

*Note: A debit note always precedes a credit note in case of a refund.

Use of Debit and Credit Note in GST

According to the GST laws, a debit note can be issued by the supplier if the taxable amount or tax charged in the invoice is less than the actual tax rate. As per section 34(3) of the Goods and Services Tax Act, there are only two situations when the seller or supplier can issue a debit note:

- When the taxable value reflected in the original invoice is lesser than the actual taxable value at the time of the sale

- When the original tax invoice shows less than the expected tax to be paid by the buyer

The GST act defines a credit note as a document issued by the seller when the amount of tax payable according to the original invoice is more than the actual tax rate on the specific goods and services involved in the sale. As per GST laws, a supplier is expected to issue a credit note to the buyer when:

- The original tax invoice that has been issued reflects a taxable value exceeding the current tax rate

- The original tax invoice has been issued, and the tax charged exceeds the actual tax amount to be paid

- In case of return due to dissatisfactory products or services of taxable items

Details to be Included in Debit and Credit Note

- The supplier’s name, address and GSTIN

- An alphanumeric serial number unique to the particular financial year

- Date of issue of the debit/ credit note

- The buyer’s name, address and GSTIN (if registered). If the buyer is not registered, their name and detailed address of delivery would suffice

- The original invoice number against which the debit/ credit note is issued

- The taxable value of goods or services, the rate of tax applicable and the amount of tax debited or credited to the recipient

- The supplier’s signature/ digital signature and a seal/stamp.

How Can Imprezz Help?

For small and large scale business owners, financial management is an all-consuming task that requires a lot of time and attention. Maintaining ledgers, hiring accountants, working on billing, getting the documentation for tax filing in order and so on can drain out the entrepreneur. To save their time and energy, they often hire professional help for their accounting needs which does not come with its challenges.

Imprezz is a cost-effective and efficient solution to all your financial management needs. From day to day bookkeeping to managing sales and purchase invoices, from inventory management to real-time tracking, data security to import articles, Imprezz takes care of all.

The easy-to-create invoicing system of Imprezz makes billing a matter of a few clicks. All you have to do is open an invoice template and feed all the necessary details, company logo, address, client details, amount of transaction, and GST details. After reviewing the whole template, you are all set to carry out transactions once you click the ‘finish’ button. In addition, automated reminders via mail will go to your client once you save their email details.

Issuing debit and credit notes against the issued invoices can be much easier with Imprezz’s invoicing technology. Your records are kept safe and accessible from anywhere; the only thing you need is a device (a computer or a phone) and internet connectivity. So no matter how many revisions, upward or downward, have to be made to your issued invoices, managing the whole invoice editing process will be a cakewalk with Imprezz.

More Blogs By Imprezz:

What is HSN Code in Invoice? The Importance of HSN Code

How can a free Chartered Accountant seat help in efficiently filling GST?

Why and How to Prepare a General Ledger?

As per the notification issued by the GST authorities in October 2020, the HSN codes are now mandatory on all invoices. According to this new regulation, GST authorities mandated the HSN code on all tax invoices from 1st April 2021. The official statement made by the Ministry of Finance clearly states that “With effect from the 1st April 2021, GST taxpayers will have to furnish HSN (Harmonised System of Nomenclature Code), or Service Accounting Code (SAC) in their invoices, as per the revised requirements”.

According to this new mandate, the number of digits in the HSN code has been revised. Now, they shall vary according to the size of the aggregate turnover of the business. Businesses with an aggregate turnover below 5 crore INR in the fiscal year 2020-21 are required to furnish a 4-digit HSN code. Businesses with an aggregate turnover exceeding 5 crore INR in the last financial year are required to furnish a 6-digit HSN code on their GST invoices. Previously, it was 2 and 4-digit codes for businesses with turnover upto 5 crores and over 5 crores, respectively.

Guidelines: Points to Remember

- Businesses with aggregate turnover above 5 crore INR in the last financial year must issue the 6-digit HSN codes on both B2B and B2C invoices.

- Businesses with aggregate turnover up to 5 crore INR must issue the 4-digit HSN code on B2B invoices

- For smaller businesses (with aggregate turnover up to 5 crores), issuing the HSN code on B2C invoices is optional

- Businesses with less than 1.5 crore aggregate turnover need not furnish the HSN code

HSN codes are standard worldwide for the ease of international trade for the systematic organisation and classification of products. Manufacturers and traders have been furnishing the HSN codes on taxable goods and services even before the GST. Importers and exporters have been regularly adding these codes on documents of import-export trade. The traders will refer to the HSN codes provided in the invoices issued by the manufacturer and importer.

Benefits

Mandating HSN codes on invoices is no new phenomena. However, with the Finance Ministry’s declaration, its use will be a lot more streamlined and uniform. This standardisation of the HSN codes on GST invoices is a welcome move. It will require manufacturers, traders and service providers to provide more specific codes on the invoices issued for the products/ supplies or services.

This, in turn, will help tax accounting officers get deeper data analytics for all traded goods/ services. Also, it will help control the tax evasion practices resulting from false invoices and irregular tax credit claims.

(Source: https://www.livemint.com/news/india/6digit-hsn-code-mandatory-in-invoices-for-biz-with-over-rs-5-crore-turnover-11617260839364.html)

Also Read:

43rd GST Council Meeting: Relief for Taxpayers and more

GST shortfall may force government to borrow $22 billion

The sprawling nexus of trade worldwide involving umpteen products, services, manufacturers, traders, and service providers can get chaotic and out of hand if there’s no standardised system of classification. This is what necessitates a nomenclature system like the HSN code.

What is HSN Code?

HSN is the acronym for Harmonised System Nomenclature. This standardised, multipurpose goods and services nomenclature came into practice in 1988 as an initiative taken by the World Customs Organisation (WCO) for facilitating the classification of products worldwide in a systematic fashion. This code is mandatory for B2B and B2C tax invoices of all goods and services.

This multipurpose product nomenclature system is accepted worldwide for systematic classification and organisation of products and services. This standard invoice numbering system is accepted worldwide to keep track of:

- What is being traded?

- How much is being traded?

- What kind of monetary transaction is involved?

- How should the transaction be taxed?

Apart from helping gauge the taxation of traded goods, the HSN code also helps keep track of import-export business transactions. The HSN code helps track all the items imported from or exported to a country, the quantity of the products and the billing involved. Thus, it makes taxation easier and helps ascertain the tax applicable on specific goods as per the laws of a particular country. It also helps calculate benefit claims.

How to Find the HSN Code with Example

Each commodity has a separate, exclusive HSN code which is formulated in easy steps. An HSN code contains:

- 21 sections

- 99 chapters

- 1244 headings

- 5244 subheadings

Each section is divided into chapters, each chapter into headings and each heading is further classified into subheadings. Section and chapter describe the broad categorisation of the products, while headings and subheadings get into a more detailed description.

For example, handkerchiefs made of textile materials have the code 62.13.90, where 62 is the chapter (non-knitted, non-crocheted clothing/ apparels accessories), 13 is the heading number for the product (handkerchief), and 90 is the subheading/ product code for handkerchiefs made of other textile materials.

Note: In India, there is a deeper classification for handkerchiefs based material of manufacture

- 62.13.90.10 (handkerchief made of man-made fibre)

- 62.13.90.90 (handkerchief made of silk or silk waste)

Importance of HSN Code:

India has been a member of the WCO since 1971; India, along with the other 200+ participating nations, have adopted this 6-digit numbering system for the following benefits:

- Systematic classification of products and services

- For the provision of a rational basis of custom tariff

- Keeping track of data analytics of international trade

- Smooth taxation process

- Controlling tax evasion practices

Latest Government Regulations

India has been using HSN codes since 1986 to classify goods for excise and customs. But with the latest declaration from the Ministry of Finance mandating HSN code on B2B and B2C business invoices from 1st April 2021, the numbering system is sure to get more standardised and uniform. According to the Ministry of Finance, “With effect from the 1st April 2021, GST taxpayers will have to furnish HSN (Harmonised System of Nomenclature Code), or Service Accounting Code (SAC) in their invoices, as per the revised requirements”.

The recent government regulations have revised the existing HSN numbering practices for small and large businesses. As per the mandate, businesses with aggregate turnover up to 5 crores INR in a financial year are now required to furnish 4-digit HSN codes instead of the previously practised 2-digit code system; this code is mandatory for B2B and optional for B2C businesses in this description.

Large businesses with an aggregate turnover above 5 crores in a financial year are required to issue a 6-digit HSN code instead of the previously practised 4-digit one. This code is mandatory for both B2B and B2C businesses in this bracket.

Small businesses with a turnover less than or equal to 1.5 crore INR in a financial year are exempted from using the HSN code.

Mandating HSN codes in the GST invoices is a welcome move for streamlining business practices; however, it involves some procedural difficulties which can be easily overcome by integrating the coding system in your invoicing technology. Let’s see how an invoicing app like Imprezz can make a difference in this domain.

About Imprezz

Imprezz is a state-of-the-art fintech service that helps small and large businesses and self-employed professionals to create and manage their invoices, quotes, financial transactions and payment reminders in the cloud with minimum hassle.

Gone are the days when a substantial amount of investment went into book-keeping and financial management. A Digital financial management platform like Imprezz takes care of your book-keeping requirements efficiently and offers several benefits like:

- Saving the expenses of the workforce engaged in financial management and accounting

- Minimising the risk of manual error

- Keeping your financial records secure

- Making financial details accessible from any part of the world

If you are an Indian business person looking for a one-stop solution to your financial management needs, Imprezz has you covered with services like:

- Accounting

- Expenditure management

- Data Security

- Real-time tracking of transactions

- Partial invoices

- Import articles

Easy HSN Code Invoicing with Imprezz

Imprezz’s invoicing program helps you write a professional and legally compliant invoice efficiently and effectively. All you have to do is start with a neutral invoice template and add all the necessary information, like the company’s logo and your address, in the stationery sender section and save it.

Enter the name and address of the client/ company and feed all the necessary details of goods/ services, their quantity and pricing details in the settings tab. Enter your GST details with HSN codes and your job is done.

Add company data and signature in the footer section and save. Your professional invoice is ready to roll.

Your invoices are directly sent to your customers via mail if you add their email details to the system. Do not forget to preview before clicking ‘finish’ to complete the procedure.

By bringing all your book-keeping needs under the same umbrella, Imprezz offers better efficiency and more secure management of your finances in just about a few clicks.

Also Read:

Importance of Real-Time tracking in Accounting Transactions

Why and How to prepare General Ledger?

How to Leverage Accounting Automation? – Small Business Guide

Gone are the days when people used to go through loads and loads of ledgers and financial statements to find that one entry they were missing. In these modern times along with everything else, accounting has been simplified as well. This is the modern era and therefore, methods of accounting have advanced as well. In this article, we are going to tell you all about the real-time tracking of accounting transactions and its importance in our daily lives.

What is Real-time Tracking of Accounting Transactions?

So, what is real-time tracking of accounting transactions? Also known as “cloud computing”, real-time tracking of accounting transactions is done using accounting software. It connects with the internet to provide access to your financial data anytime and anywhere you want – from any device.

This innovative technology has indeed simplified the complex accounting journal writing and calculations. As compared to older times when accountants needed to prepare heaps of ledgers and journals, this new technique is going to simplify the method of accounting transactions available at any time of the day.

These days accountants and the finance department usually prepare their books of accounts on their respective laptops/tabs. Thus, data is only accessible when they have their laptop or tab near them. Real-time tracking system allows you to access the whole data at your convenience. Hence, you can make even the smallest changes without having to go through everything.

But all of this is not as simple as it seems. This process requires reliable accounting software that enables access to financial data at your fingertips. One such software that we would like to talk about here is Imprezz.

About Imprezz

Imprezz is one of the leading invoicing and finance programs that allows small businesses and self-employed people to create their quotes, invoices, financial transactions, and reminders directly in the cloud which makes the whole process convenient.

Imprezz is by far one of the best accounting and billing software used in India. It allows users to easily access their bookkeeping accounts and manage them as per their liking without rushing anything. Imprezz offers numerous features like accounting, data security, expenditure management, partial invoices, real-time tracking of accounting transactions, and more.

If you are living in India and looking for reliable software that will not only be easy to use but also affect positively to solve all your accounting problems then Imprezz is highly recommended. This accounting software will allow you to access all your financial data in one place, any time of the day.

How Can You Do Real-Time Tracking of Accounting Transactions Through Imprezz?

As we all know, the industry of accounting is running smoothly and is at its peak when it comes to real-time tracking. This latest trend has enabled businesses to invest in the best accounting softwares that are available in India like Imprezz. With the help of real-time tracking of accounting transactions, companies are introduced to easier ways of accounting solutions. Also, they have found a replacement of accountants who can perform manual errors.

Imprezz is one of the modern accounting software in the market in India. It has a lot to offer when it comes to real-time tracking of accounting transactions. This software will allow you to access your books of accounts at any time and anywhere. There are numerous ways in which Imprezz can help you in getting done with your complex financial issues with minimum headache and effort.

What are the Advantages of Choosing Imprezz?

When you start a company, it needs a lot of investment. You might invest in shares, transport, computer systems for accounting, investing in your newly built office, and whatnot. But often when it comes to investing in accounting software that will simplify real-time tracking of accounting transactions, businesses bailout.

This happens to people who are not so confident in investing in accounting software. It is because these clients are not aware of the many benefits which come along with this software. These benefits are stated below.

1. Profit and Loss

The benefits of real-time accounting can be seen clearly when you access the profit and loss or the income statement. Instead of calculating everything again from the first entry, you are just one click away from getting to know how your business is doing with other businesses or your clients in India. This is how simplified our lives can become with accounting software, like Imprezz.

2. What Needs to be Updated and What’s Outdated?

Handling a lot of channels these days is not an easy task to perform. You may have to double-check all the platforms where you are providing services like Amazon, eBay, Shopify, etc. With the help of using real-time accounting software, you will not only be able to see the accounts of all your active channels, but you will also be able to decide which channels are working for you and which are not.

When a person or business is handling too many channels at once, they might make the common mistake of thinking that one channel is doing better than the other when in reality, it is the total opposite. To avoid this from happening all you have to do is download one of the best and latest real-time accounting software such as Imprezz. It will allow you to access all your important data in one go.

3. Faster Detection of Fraud and Errors

As transactions are posted immediately in real-time accounting transactions software, you will be able to rectify the mistakes made a lot sooner as compared to other means of financial activity. This means that you will be able to tell when the balances of your accounts are not lining up. In this way, you will be able to take action more quickly.

Sometimes there can also be fraudulent activity going on which can refine or damage your controls. But with the help of Imprezz, all such problems will be solved because it does not allow any errors or frauds to get anywhere near the data of its clients. This is because the data on Imprezz is protected by the latest technology debugging programs.

Overall, the accuracy of your business will improve over time and you will be able to notice a positive change in the performance of your business while taking care of all the financial activities that are going on in various channels. You will be able to handle everything in just one place. So, what are you waiting for? join today and enjoy!

Also Read:

How can a free Chartered Accountant seat help in efficiently filling GST?

Importance of Team Collaboration Feature

How to Leverage Accounting Automation? – Small Business Guide

Cloud accounting software is the best investment to scale your business. You can easily collaborate with your Chartered accountant and team members for GST filing and other financial decisions.

With the advancement of technology, more and more firms are looking to embrace cloud networks for their business activities. This software allows them to enhance their functionality and deliver more value to customers. The accounting software by Imprezz enables accountants and professionals to access data anywhere, anytime. Having real-time insights about data helps accountants and financial advisors to make strategic decisions about business’ financial activity.

The wide-scale adoption of cloud software by companies has transformed the method of team collaboration. The cloud-based accounting software allows companies to unite at a single place and work together with accountants and financial advisors. This software provides real-time support to the firms and allows them to work in close liaison with their team without the location constraint.

Also Read: How to find best accounting software?

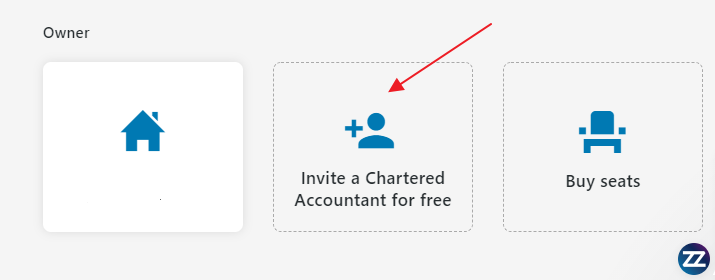

What is a Chartered Accountant Seat Feature?

Chartered accountant seat is a collaborative feature provided by Imprezz, which allows you to buy seats and invite team members. Bringing together external accountants, internal accountants, CA, and team members, the feature allows everyone to work in a cohesive environment. Everyone can access specific data files, get real-time updates along with reporting and analysis.

The accounting software emerges as a cornerstone for every business, especially when everyone is working from home. It removes the constraint of being present in the office to access files.

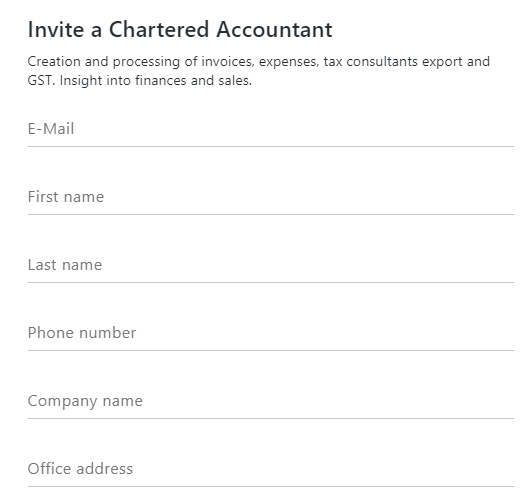

The feature of “Chartered Accountant Seat” is provided by Imprezz under team collaboration. It allows you to invite a Chartered Accountant for free. However, to buy seats, you have to first create your account and change your subscription to a paid plan.

Image Source :Imprezz

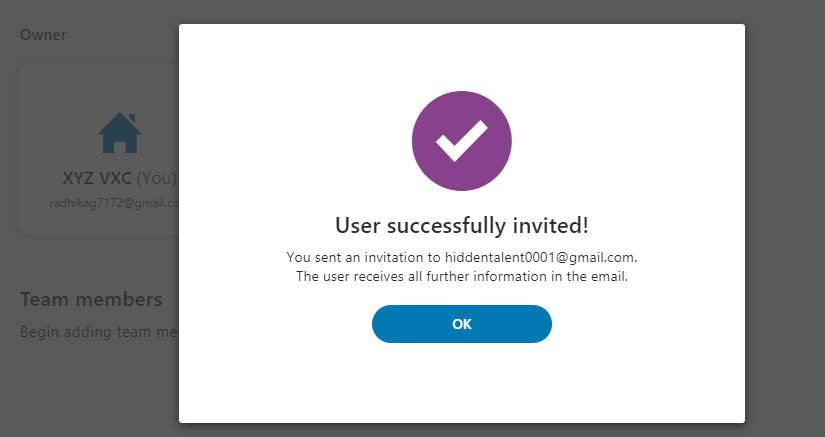

To send an invite to a chartered accountant, you have to enter his details —Email, Name, Phone Number, Company Name, and Address. Once you send the invite, the user will receive all the information in the email.

Your chartered accountant will receive an email asking you to Join the invitation link sent by you.

The feature of “Chartered Accountant Seat” allows your CA to extract all reports for GST filing. Thus there are fewer chances of you missing the deadlines. Once your chartered accountant accepts the invite, his account will appear under the option of “Team.”

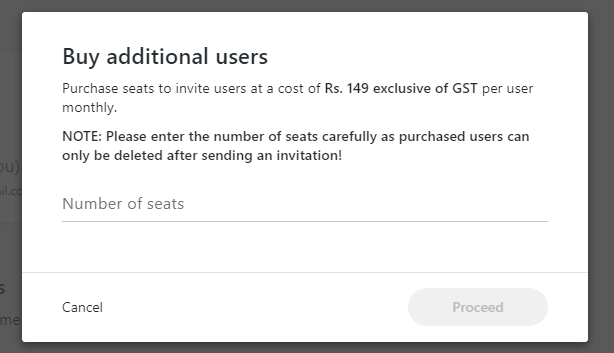

If you want to buy additional users, you can purchase seats for RS.149/- exclusive of GST per user every month. The number of seats purchased can only be deleted after an invitation is sent.

What it allows Chartered Accountant to access?

The cloud accounting software allows chartered accountants to access documents, data, and reports in real-time for effective GST filing. In addition, the “Chartered Accountant Seat” feature allows accountants to communicate, manage everything in one place without the need for sequential operations.

This is also the most efficient feature for accountants. They don’t have to be present in the office to access data because everything is saved on the cloud network.

The feature of “Chartered Accountant Seat” offers multi-user access with separate login credentials for each user. You no longer have to share data over email or hard drive, thus ensuring privacy of important data within the company. Firms can work closely with their team and chartered accountants, making it easy to access and collect files whenever, wherever.

The feature allows chartered accountants and other accountants to –

- Collect and share documents with online software.

- Match invoices for a specific period and reconcile accounts through this software

- Exchange files with firms, assign tasks, collaborate on edits from any device.

- Track bills and invoices without asking to share over email.

- Send and receive financial documents and file tax returns.

In a nutshell, multi-user accounting software enables business owners & chartered accountants to collaborate and make the best of financial data. CA can help in financial reporting, auditing, or any other financial process. With real-time sharing of financial data, business owners can save time and run their business with efficiency.

How can it assist in smooth GST Filing?

One of the most sought-after features of cloud-accounting software is enabling you to collaborate with your team seamlessly. You can invite your chartered accountant and buy seats for other team members to help file taxation and make crucial financial decisions.

Compiling with taxation can be an intimidating task for business owners. All the business entities, whether small or large, have to file GST returns as per the prescribed regulations of the Government of India. Any deviation in GST filing can result in rejection of input tax credit or penalize the business owner for non-compilation with norms.

Hence, the cloud accounting software and feature of the chartered accountant seat can help them track financial records, file returns on time, maintain book-keeping records, GST invoices, and much more.

Additionally, taxation policies and rules regarding GST keep amending every financial year. Hence the collaboration with chartered accountant helps companies to file GST returns according to the latest amendments.

Conclusion

Adopting cloud accounting software makes it easy for you to manage everyday business tasks efficiently and accurately. You can automate the process of generating quotations, invoices and sending payment reminders. The software allows you to have a complete overview of your business expenses and incomes.

If you are still using spreadsheets or conventional accounting software, it’s high time to opt for multi-user accounting software. Take a demo with Imprezz today and see how it feels to stay on top of your finances. The best thing is that it offers you the autonomy to work from anywhere and collaborate with your chartered accountant and other team members.

Are you using cloud accounting software for your business? If not, we’ll be glad to see you on the other side.

OTHER BLOGS BY IMPREZZ

Importance of Team Collaboration Feature

How to Leverage General Accounting Automation: Small Business Guide

Why and How to Prepare a General Ledger?

The GST council met after six months for the 43rd council meeting on 28th May 2021. Finance Minister Smt Nirmala Sitharaman chaired it. The Union Minister of State for Finance and Corporate Affairs – Shri Anurag Thakur, the Finance Ministers of the states and UTs and other senior officers of the Ministry of Finance and the States and Union Territories, were all present at the meeting.

Here’s what was discussed:

- The GST rate on Covid-19 medicines will remain the same at 5%. GST council ruled out the possibility of adding covid related materials amongst zero-rate supplies.

- Goods and Service Tax exemption is provided on importing covid relief materials and medicines until 31st August 2021. The list includes Amphotericin B – the medicine for black fungus.

- For taxpayers who have delayed the filing of GSTR-3B, a GST Amnesty scheme was announced to reduce the late fee. Alongside, the maximum late fee on GST returns for small taxpayers has also been reduced for the future.

- The late fee waiver and interest reduction is announced for

- Filing of GSTR-3B & PMT-06 for March, April and May 2021

- Submission of CMP-08 for January to March 2021

- Companies can continue using Digital Signatures instead of EVC for filing returns.

- There’s a 15 days extension for filling IFF and GSTR-1 for May 2021. Meanwhile, the due dates for GSTR-4 for FY 2020-21 and ITC-04 for Jan-Mar 2021 returns are also extended till 31st July 2021 & 30th June 2021, respectively.

- Filing of GSTR-9 will continue to be optional for businesses with turnover up to 2 crores. At the same time, GSTR-9 will continue to be applicable for taxpayers with annual turnover equal to or over 5 crores.

- For the GST compensation cess, the same formula will be used as the previous year. Also, the Centre will borrow 1.58 lakh crores as projected to compensate the states for the shortfall for GST cess.

- The time limit for completing compliance or taking actions due between 15th April to 29the June 2021, under the GST law, is extended till 30th June 2021.

- As per the law committees’ suggestions, the Quarterly Return Quarterly Payment (QRQP) scheme will be introduced.

The topic of Inverted tax went unattended at the meeting. Even though the Inverted tax is continuing to hurt sectors like fertilisers, pharma, solar panels, textiles, etc.

(Source: https://www.cnbctv18.com/views/43rd-gst-council-meeting-need-to-focus-beyond-covid-19-pandemic-9517251.htm)

Also Read:

E-invoice mandatory for business with turnover over 50 Cr

Covid-19 Crisis Makes Govt Extend GST Timelines

GST Rules for Start-ups in India

Due to the Goods and Service Tax (GST) shortfall, the government of India may need to borrow more for the second year straight. This government will use this amount in compensating the states for their revenue loss during the shortfall.

The requirement in the amount to be borrowed is estimated to be Rs. 1.58 lakh crores ($21.7 billion) in this fiscal year since April 1. A dedicated panel will meet to further discuss this issue of compensation to states, among other issues, this Friday.

People with knowledge about this matter say that the compensation amount in question to be paid to the states add up to be around Rs. 2.78 lakh crores. But the government might be able to compensate only about Rs. 1.1 lakh crore. Calls made to the finance ministry were not answered, they said.

The compensation was part of The Central Government’s agreement to pay states for any revenue loss in case of the centralised nationwide GST. The unpredictable pandemic cost serious problems in tax collection, forcing the central administration to consider additional borrowing.

The decision to borrow, the amount and the timing will be regulated after consulting the Reserve Bank of India. The payment of compensation to the states was supposed to be for five years starting from 2017. However, the government has extended it beyond 2022 to meet the gap in revenue due to the pandemic.

The GST receipts have come in with the correct amount of 1 lakh crore for the past 7 months since April. The states are worried about the continuation of the same due to the lockdown imposed in most states. The panel will meet on Friday to discuss further the continuation of the compensation, the exact amount to be borrowed, the timeline of submission and the outcome of consultation with the RBI about the decision to borrow.

Also Read:

Covid-19 Crisis Makes Govt Extend GST Timelines

E-invoices mandatory for businesses with turnover over 50 Cr

Inventory Management Software: Advanced Features

Money is the most crucial aspect of a business, and accounting is the art of managing this aspect. The sphere of accounting has evolved over the decades. Now, especially with technology taking over, the revolution has been tremendous.

Businesses have started adapting to the technology of the future – cloud-based software. With cloud-based software, all accounting activities are carried over the internet, not requiring physical storage or presence. Accountants and other team members can log in to the software from any location, provide real-time insights, business projections, etc.

As the business environment evolves, multi-user software has become the need of the hour. A software that allows various users to log in simultaneously and perform accounting activities. This is also relevant because accounting software has grown in terms of usage. Now multiple other departments like sales, human resource, operations, etc., also require access for performing daily tasks.

Team collaboration in accounting software

SMEs feel team collaboration feature is beneficial for them due to the team size, although that’s far from truth. No business can carry out operations without effective partnership amongst members from the same and other departments.

After all, the business environment has developed into such an advanced sphere. Fortunately, so have the technology. Imprezz software allows upto ten members to log in, access and share the accounting information at various levels.

Accounting software that allows team collaboration has gained enormous limelight due to remote working. SMEs have also adapted to the situation, thus increasing the need for an effective team collaboration tool. While there are separate tools for team collaborations, software like Imprezz has integrated it with accounting operations services. The convenience of streamlined actions and advanced features have made Imprezz the top pick for SMEs.

Why is the team collaboration feature important?

Multi-user access

Accounting software has evolved to provide advanced features like multi-user access. A multi-user access feature allows various team members to access the data with their separate login credentials. It eliminates the need to share documents over a hard drive and the risk of losing the secrecy of such documents. Users can access relevant information according to their roles and responsibilities, ensuring secrecy while also maintaining efficiency in each task.

Easy communication

Communication can either make or break your business. Every department in every organisation needs to have a proper channel of communication to maintain a seamless flow. Hence, accounting software like Imprezz provides a messaging service as well. Team members can ping each other personally or in a group chat to share relevant accounting information.

Task management

A businesses efficiency is measured by its peoples’ efficiency. When employees start performing, results automatically improve. Imprezz accounting software allows you to manage and collaborate across teams and departments to share and supervise tasks.

Businesses can create a timeline for each action and navigate the progress in a single space. Thus, ensuring no task goes unaccounted for and is taken care of by the right person.

File sharing

Accountants require documents to be shared back and forth. Storing and sharing books and statements can be a tedious task. Thus, the software allows multiple users to access and share files in real-time. It adds to the efficiency of operations and team members.

Also, it is essential to use secure software like Imprezz for tasks as critical as managing money.

Collaboration across departments

Accounting software has evolved over the years. From serving the needs of a specific individual to catering to the demands of members across the departments. Imprezz allows sales professionals to access quotations and bill invoices while the internal and external accounting professionals obtain information on expenses, orders, etc., to create accounting statements.

The management can use their admin access to control and supervise the activities. Also, keep an eye on the statements and business operations.

It creates a healthy collaborative environment and increases productivity.

Tailored access

One of the most lucrative benefits of multi-user software is the ability to grant customised access to different users.

In Imprezz, the user with admin access controls the entire software. They can grant login access to others, assign tasks to the concerned person, restrict their access to the information, etc.

The accountants can access all the business information on the software as they have to handle the internal finance. The only point of difference is, accountants do not get access to the configuration settings.

Also, the sales or purchase department personnel will have access to only the required fields. Say, the sales department is responsible for invoicing and quotations, so they’ll have access to the concerned tabs. The purchase department will focus on inventory management and other related accounts.

Tailored access allows business to keep their sensitive information secured and only allow necessary personnel to tap onto it.

Accounting with Imprezz

Imprezz is a leading cloud-based accounting software tailor-made to cater for the needs of Indian businesses. It fulfils the business requirements for invoicing, Inventory tracking, GST compliance, auditing, etc.

The cloud-based software provides autonomy to work from remote locations. It ensures your business does not have to restrict access to external accountants based on location. Additionally, Imprezz also provides dedicated support to solve your accounting queries.

You can organise your finance, customers and accounting with ease.

Create legally compliant invoices online with our software and send them to your customers with a click of a button. You can automate various business actions like recurring invoicing, sending payment reminders, etc. Thus allowing you to utilise your time better.

Track and manage inventory to avoid the trouble of understocking or overstocking. Create purchase orders and set reminders when stock is low.

Comply with GST regulations without hassle. Create GST compliant invoices and quotations for customers, provide accountants with documents for filings and ensure a seamless flow.

Simplify your accounting practices with Imprezz and come at par with competitors. Login and avail the 14 days free trial today.

MORE BLOGS BY IMPREZZ

How to leverage Accounting Automation?

Tutorial: How to use Imprezz Inventory Management Tool?

Cloud Accounting Software: Benefit and Features

Accounting is the measurement, processing and communication of financial and non-financial transaction of business entities. Some also refer to it as the science and art of tracking monetary events. This measurement, processing and communication require numerous financial statements to be prepared from time to time for various purposes. It starts with preparing journal entries for each transaction, followed by posting them in the ledger account.

The general ledger is the main record-keeping document of the company’s financial reports. It keeps a summary of every transaction under separate heads and makes the lives of business owners and accountants simpler.

Why do businesses create general ledger?

The general ledger is a means of recording the financial accounts of a company. Businesses following a double-entry bookkeeping system create the general ledger account. Herein every transaction is entered twice, once as a debit and then as a credit.

Businesses follow this method since it makes the classifying of transaction a lot simpler.

Some other benefits of preparing a general ledger are-

Summarise transactions: The business transactions are summarised in the general ledger. All the transactions relating to a head come under a single tab. Thus, it becomes easier to keep track of transactions and take decisions.

Helpful in preparing trial balance: Ledger accounts are an integral part of accounting. A business can’t prepare a trial balance sheet without preparing ledger accounts. This is simply because trial balance is prepared by taking balances of the ledger accounts.

Helps in determining profit– Ledger account balances are necessary for preparing crucial financial statements of a business. These statements give us a clear picture of the profit or loss of a business.

Helps with taxes: A ledger account is highly beneficial when calculating tax liability for your business. It saves you all the trouble of running through each receipt to identify and record revenue and expenses. Since you’ve already posted every transaction in the general ledger, it saves you time, effort and potential loss of money.

Types of General Ledger account

Asset Account

An asset is a resource owned or controlled by a business entity that can derive positive economic value. These resources can be tangible as well as intangible.

In this section, we record all the journal entries related to the assets of the organisation. There can be multiple ledgers for various assets. The asset accounts can be grouped as current assets and long-term assets. It includes cash, accounts receivables, inventory, investments and fixed assets.

Liability Account

A liability is anything that a business entity or an individual owes. It is a result of transactions done in the past. An obligation (liability) on you becomes an asset to the party you owe.

Liabilities can be grouped as current and long-term. Herein, the entity records its obligations, debts, customer deposits and prepayments, etc. The liability account may include notes payable, accounts payable and accrued expenses payable.

Revenue Account

Revenue is the income generated by sales of goods and services related to a business’s primary operations. They are also known as ‘gross sales’ in business terms.

Revenue can also be defined as the asset earned by a company’s business activities. In this section, all the journal entries related to cash or receivables received for sales of good and services are included. The revenue account is usually credited as the income is earned. Only in cases like sales refund or good return, we debit the revenue account.

Expense Account

In accounting terms, the expense is the cost incurred or money spent by an entity to generate revenues. Businesses record them on cash as well as on an accrual basis.

This section records all the transactions related to expenditure or payables resulting from an action carried out to increase income. An expense account is debited as the expenditure is incurred.

Stockholder’s Equity Account

Equity is defined as the money funded by the owner or stakeholder of a company. It includes both, money funded in the initial start-up of a business and its continuous operations. Also, the stockholder’s equity represents the remaining value of assets after all the liabilities are paid off.

It can be calculated by deducting total liabilities from total assets. And, another method to do so is to adding share capital to retained earrings and subtracting treasury stock.

How to prepare a general ledger?

Before they start preparing the accounting ledgers, businesses must first record all the transactions as journal entries.

Journal entry is the first step of the accounting system. It refers to the act of recording all the business transaction. Every transaction is taken into the record, and the debit and credit aspect of the transaction is determined.

Now, once journal entries are recorded, the accountants identify separate heads start preparing an individual account for each head. For example- cash, stock, machinery, accounts payable, etc. These are ledger accounts.

We record the credit aspect of a journal entry on the credit side of the ledger account. Similarly, the debit aspect of an entry is recorded on the debit side of the concerned ledger account.

The entries are added date-wise into the ledger.

Once all the transactions are posted in the respective ledger accounts, we start the process to close the accounts.

Now, we calculate the totals on each side, debit and credit of the ledger account. If the totals are equal, our task here is done. But in other cases, when the sum is not equal, we subtract the lesser total from the higher one. And the balance is added into the ledger account as a separate record. It is then carry forwarded to the next month/year.

The process of posting in ledger accounts is a lot simpler than it sounds. It can easily be automated since it is based entirely on journal entries.

Nowadays, businesses use software to carry out such accounting tasks. Imprezz is a cloud-based accounting and billing software serving all accounting demands of SMEs. It has inbuilt GST compliant invoice templates, which you can further modify to make your billing process smoother.

Opt for a 14-days free trial today!

ALSO READ:

How to Select the Best Accounting software?

Cloud-Based Invoicing Software: Simplifying your business

GST Rules for Start-ups in India

Clearing the air, the Institute of Chartered Accountants of India (ICAI) has issued a guidance note for e-commerce businesses named ‘Accounting for E-Commerce entities’ over recognising the expenses and revenues in the financial statements.

E-commerce is simply buying and selling goods and services over the internet. The industry is taking over; stats suggest that in 2020, the global e-retail sales surpassed 2.8 trillion US Dollars. The revenues and sales are not just by traditionally selling products and services but mainly through subscription, loyalty programmes, advertising, other services like content selling, etc.

Also, in such transactions, the responsibility to deliver goods and services falls on the e-commerce entity. Thus, it is crucial to determine when the risk and rewards of ownership get transferred.

The ‘Guidance Note on Accounting for Dot Com Companies’ has been revised, and the new ‘Guidance Note on Accounting for E-commerce entities’ provide clarity on accounting issues arising on various accounts like membership and subscription fees, revenue from auctions, multiple element arrangements and advertising, and treatment of costs of point and loyalty programmes, etc.

The note applies to companies that prepare financial statements under Companies (Accounting Standard) Rules 2006, amended under Section 133 of Companies Act, 2013. The guidance note also applies to LLPs and Partnership firms.

The guidance note also clarifies the ‘Right to Return’ against goods or services or coupons. It gives customers the right to exchange goods or services sold against other goods or services. It also deals with the revenue recognition perspective of web hosting services, advertising services, etc.

Another aspect of e-commerce, resellers and consignment agents, are also covered under this note. It elaborates that the risk and reward risk and reward in the case of consignment agents do not get transferred. Hence, the buyer, i.e. the dealer or agent, gets physical possession of the goods but does not assume all the risks and rewards.