Every registered person under GST must self-assess the tax obligations under section 59 of the CGST Act 2019. Taxpayers must file GST returns with assessed documents within the pre-determined tax period. The department of Goods and Services Tax (GST) in India looks into each compliance submitted on the government portal; examines, audits, or investigates each document filed by the designated taxpayer. The process of compliance verification requires taxpayers to remain accountable by maintaining accounts and records under GST.

Every business/taxpayer must record each transaction carried out at the principal place of business or taxable activity. Which company or registered person must maintain accounts and records under GST? What are the necessary documents listed under the GST regime? This article is a comprehensive GST accounting and record-keeping guide. Find out more in the segment below!

GST Record Keeping and Accounting

Real-time invoicing, and maintaining accurate accounts and error-free records are mandatory for every registered taxpayer under the Goods and Services Tax (GST) regime, section 35 (1) of the CGST Act 2017. Business owners must maintain these accounts and records at the place of business, as stated in the Certificate of Registration.

Accounting and Record-Keeping Rules

Rule (1): Registered Taxpayers Have Multiple Workplace

Taxpayer registered under GST can operate with more than one workplace. Business operations can be conducted from multiple locations. A company might have its branches in different cities or states. In such cases, business owners must install a designated accounting system for each workplace specified in the Registration Certificate. Implementing an online accounting software bifurcates record-keeping hassles by enabling a unified billing platform with multiple user access.

Contact Imprezz customer support team to know the perks of installing digital record-keeping and accounting system for your small business. Check out the software, the pioneer of invoicing and billing systems in India.

Rule (2): Recording Incorrect Entries

Taxpayers must pay attention to specific details while recording entries for bookkeeping. Every registered person must ensure each transaction reported either in records or ledgers are neither overwritten nor erased. Inaccurate entries must be fixed by replacing them with correct entries. In digital bookkeeping methods, business owners must keep a record of each entry deleted or edited.

Rule (3): Keeping Records in a Place Not Mentioned in the Registration Certificate

Sometimes, taxpayers subjected to certain circumstances maintain their books at a location not specified in the registration certificate. In such cases, regardless of the reasons, accounting books are considered to be kept by the person who owns that property.

Rule (4): Recording Files Electronically

Business can now maintain their accounts electronically over the online platforms. The Indian government is adopting digitalization as a step-by-step process. Records in the GST returns of each taxpayer is closely examined and validated by digital signatures. Online accounting enables data backup facilities; any lost record can be retrieved in a reasonable period. The business accounting data on the software is secured through password protection.

Rule (5): Producing Accounts and Records Before the Law

When required by the law, taxpayers must produce their accounting books before the government or enable access to the documents by providing passwords, etc.

Who Should Maintain Accounts and Records Under GST?

The (CGST) Central Goods and Services Act mentions that each individual, whether registered or not, must maintain accounts and records under Section 35 of the GST law. The list of individuals includes the following:

- Business Owners

- Warehouse Owners

- Transporters

Warehouse owners are supposed to maintain accounts and records for the period during which warehouse is operational, and goods are stored in it can be recognized as an item. The accounts maintained must include all the documents and details related to shipment, transportation, receipt and disposal of the stored goods.

It is crucial to maintain records for any business or taxpayer; it helps assist physical verifications or on-demand investigations. Thus, a transporter’s responsibility is to keep accounts concerning the goods that are:

- Transferred

- Delivered

- Stored in Transit by the Transporter

Transporters must also keep a record of registered supplier and recipient GSTIN number for each branch.

GST Accounting Rules for Business Owners, Operators and Carriers

Rule (1): Request for Registration Number by Unregistered Individual

Unregistered business owners who are liable to maintain accounts and records under GST must provide business activities information. The process of uploading business documents is done electronically over the GST portal by filing GST ENR-01. Once all the documents are thoroughly verified, the government issues a Unique Enrolment Number (UEN) to the designated business owner.

Rule (2): Requesting for a Unique Common Enrolment Number for Multiple Branches in More than One State

Suppose a transporter operates in multiple locations outside the state or UT (Union Territories) with the same Personal Account Number (PAN). In that case, he/she must request a Common Enrolment Number through form GST ENR-02. Any one of the GST numbers is given as the Common Enrolment Number after verifying all the details.

What Records Should be Maintained Under GST?

1. Accounts of Stocks

Registered taxpayers excluding those registered under the composition scheme (composition dealers) are supposed to maintain accounts and inventory records of the goods that the concerned taxpayer delivers or receives. The inventory records must include necessary details under the GST law.

- Opening Stock Balance

- Receipt of Goods

- Supplied Goods

- Lost/Stolen/Damaged Property

- Cancelled Goods/Delivered Gifts or Free Samples

- Stock Balance, Raw Materials, Finished Products, Wastage, etc.

2. Accounts Received and Paid

Taxpayers must maintain accurate records of accounts received and accounts paid along with all the adjustments carried out in this regard.

3. Liability and Input Tax Credit (ITC)

Alongside keeping records of accounts received and paid, taxpayers must also maintain records of other accounting activities.

- Accounts Payable

- Collected Taxes

- Tax Paid

- Input Tax Paid

- Input Tax Credit Claimed

- Register of GST Invoices

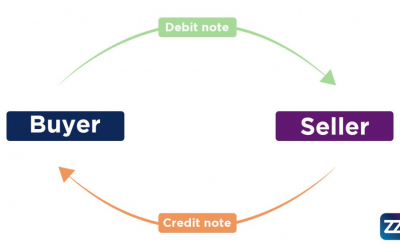

- Debit/Credit Notes, Delivery Challan (Issued or Received)

4. Supplier, Customer and Warehouse Details

Registered Persons must also keep records of other details that include:

- Supplier’s name and address

- Customer’s name and address

- Address of the location where goods are stored, including items stored during transportation and storage information of the stocks.

5. Records of Goods Production

Registered taxpayers must record the data concerning the goods produced detailing the production filed monthly. The entries must include all the information regarding raw materials, services, wastage and other by-products used to produce goods.

6. Records of Services Supplied

Registered taxpayers providing services must maintain the following accounts and records under GST.

- Goods Used in Production of Services

- Input Services Used

- Services Offered

7. Records Related to Work Contract

Every registered person dealing with the implementation of work contracts must maintain the accounts that include the following.

- Names and addresses of the individuals subject to the contract.

- Details of amount, quality, goods or services received during the implementation of the contract.

- Details of amount, quality, goods or services used in performing the contract.

- Information about received payments concerning the contract.

- Name and address of the supplier supplying the goods or services to the concerned taxpayer.

What Are the Mandatory Accounts to be Maintained Under GST?

The Goods and Services Tax (GST) regime states that a registered taxpayer must maintain various adjustments like purchases, sales, stocks and other accounting activities, as mentioned in the article above. However, here’s a list of accounts that must be maintained by the companies registered under GST.

- CGST – Input Account

- CGST – Output Account

- SGST – Input Account

- SGST – Output Account

- IGST – Input Account

- IGST – Output Account

- Electronic Cash Ledger (it is maintained on the GST portal to pay returns)

Accounting Entries Under GST

The GST Council in India has successfully provided clarity in accounting and bookkeeping, regardless of the challenges encountered in the returns filing process and operations. Several accounts are subject to GST. However, once you understand the accounting entries, it is much easier to keep records. Taxpayers can easily benefit from the tax regime if they know how to write off their taxes and claim Input Tax Credit.

Electronic Cash and Credit Ledger

Under GST, the taxpayers are subject to electronically maintain three GST ledgers that are automatically generated during online registration.

1. Electronic Cash Ledger

The cash ledger under GST plays the role of an electronic wallet. Taxpayers use electronic cash ledger to process the GST payment of tax. The registered person has to deposit money into his/her cash ledger (wallet) to make payments.

2. Electronic Credit Ledger

The credit ledger reflects ITC on purchases under the categories of IGST, CGST and SGST. The balance calculated from this ledger is the amount to be paid while processing tax payments like interests, fines, etc.

3. E-Liability Ledger

The ledger reflects the total tax liabilities of the taxpayer after compensating for the specified month. Liability ledger is auto-populated.

Period for Preservation of Accounts Under GST

Taxpayers must preserve accounts and records maintained along with the invoices, credit/debit notes, bill of supply, delivery challans issued on stocks and details of outward supplies/inward supplies at least of a period of six months. The specified period is calculated concerning the due dates for filing annual returns under GST to which the aforementioned accounts and records relate.

These accounts and records must be retained in every relevant workplace mentioned in the Certificate of Registration. However, any registered person who is a part of proceedings or investigation of an offence must maintain records concerning the inquiry event, either for a year or six months, whichever is later.

Conclusion

Registered individuals and businesses must maintain error-free accounts and records. If taxpayers fail to maintain adequate records, they will be treated as unaccounted goods or services and tax liabilities will be calculated accordingly. The registered individual will have to pay the tax liability along with the fine amount. Rid of the hassles of maintaining records, stop wasting your time on manual accounts processing. Implement Imprezz GST billing software to stay GST complaint.

We offer a 14 days free trial software program for MSME in India. Log in to get started!