The Goods and Services Tax (GST) regime has subsumed all the indirect taxes in the past few years of its successful implementation. However, the new tax calculation system has streamlined indirect taxes. The government has unified the current and previous tax systems by introducing “Supply Under GST” – Time, Place and Value of Supply. GST is classified into three types, namely, SGST, CGST and IGST. Taxpayers can apply GST charges on their e-invoices based on this classification. Under GST, “Supply” is primarily enforced by the government to help taxpayers determine whether a particular transaction falls under SGST and CGST (intra-state transactions) or IGST (inter-state transactions). The GST regime has established specific rules and provisions for determining the time, place and value of supply. This Comprehensive GST Guide is a key to understand the concept of “Supply” under GST. Being aware of the different supply types will enable you to issue GST compliant e-invoices and accurately file your GST annual returns. You can also use Imprezz business intelligence software to create GST compliant invoices and file your returns with a click of a button.

The Goods and Services Tax (GST) regime has subsumed all the indirect taxes in the past few years of its successful implementation. However, the new tax calculation system has streamlined indirect taxes. The government has unified the current and previous tax systems by introducing “Supply Under GST” – Time, Place and Value of Supply. GST is classified into three types, namely, SGST, CGST and IGST. Taxpayers can apply GST charges on their e-invoices based on this classification. Under GST, “Supply” is primarily enforced by the government to help taxpayers determine whether a particular transaction falls under SGST and CGST (intra-state transactions) or IGST (inter-state transactions). The GST regime has established specific rules and provisions for determining the time, place and value of supply. This Comprehensive GST Guide is a key to understand the concept of “Supply” under GST. Being aware of the different supply types will enable you to issue GST compliant e-invoices and accurately file your GST annual returns. You can also use Imprezz business intelligence software to create GST compliant invoices and file your returns with a click of a button.

What Is the Meaning of Supply Under GST?

As per the GST regime, Supply is an event under which taxes are charged. Any transaction of goods/services is considered as a supply by the government when an event meets the following criteria.

- The supply must be of goods or services.

- The supply must be taxable.

- The supply must be made by the taxpayer.

- The supply must take place within a taxable area.

- The supply must be made in exchange for cash or reward.

- The supply must be made in the course of business or in the interest of developing a business.

What Are the Types of Supply Under GST?

The supply of capital goods and services under GST is broadly classified into two main categories – Taxable Supplies and Non-Taxable Supplies. Further, it is classified into different sub-categories in accordance to the nature of supply.

1. Taxable Supply

Goods and services supplied under GST are termed as taxable supplies. Registered taxpayers can claim Input Tax Credit (ITC) under GST on the purchase of taxable goods or services.

- Regular Taxable Supply

Supply of any goods and/or services that incur a GST rate higher than 0% within India’s territories is termed as a regular taxable supply.

- Nil-Rated Supply

Supply of any goods and/or services that incur a 0% GST rate within India is termed as nil-rated supply.

- Zero-Rated Supply

Supply/Export made to an SEZ or consider deemed exports; applicable GST rate on these supplies is 0% (i.e., the rates applicable becomes zero) even though they incur a tax rate higher than 0% when sold within India. This category of supply is known as zero-rated supply.

2. Non-Taxable Supply

The supply of goods and services that is not leviable under the GST Act is termed as non-taxable supply. Non-taxable supplies are either exempt goods or do not qualify to claim Input Tax Credit in GST.

- Exempt Supply

The supply of exempt items or services that do not incur GST charges despite being under the purview of Goods and Services Tax (GST) is termed as exempt supply. A registered person cannot claim ITC on inputs that fall under exempt supply.

- Non-GST Supply

Supplies that are not subject to GST; it refers to the supply of items that fall outside the purview of the GST law. Note: Sale of goods from a non-taxable region to another without entering Indian provinces, stored goods sold to consumers before they pass clearance for consumption, and sale of goods related to foreign sales should not be considered as a Supply.

Components of Supply Under GST

Supply under GST is considered as a taxable event that helps determine and charge tax rates. The concept of supply can be divided into three sub-topics namely;

- Time of Supply

It defines the moment when a particular transaction of goods or services are supplied. When a supplier is aware of the transaction time, it helps determine when the associated GST payment of tax and GST return filing are due to be paid.

- Place of Supply

It defines the place where a particular transaction of goods or services is supplied. The location helps determine whether the transaction is an inter-state supply, an intra-state supply or an external trade; enabling taxpayers to understand the type of GST associated with the transaction.

- Value of Supply

It defines the value of a particular transaction of goods or services supplied. Determining the supply value helps calculate the amount of tax payable. If the supply value is incorrect, the tax rate charged on the invoice will also be wrong.

Time, Place & Value of Supply Under GST: Briefly Explained

1. Time of Supply Under GST

Section 10 (Chapter 5), CGST (Central Goods and Services Tax) Act 2017 defines the time of supply; the section states that the leviable tax rates entirely depends on the timing of the supply of goods and services. In simpler words, the taxable person is supposed to pay GST when the goods and services are supplied. Under the GST Law, the provisions concerning the supply of goods are different from that of the supply of services. Here’s what you need to know about the differences.

Time of Supply of Goods

The time of supply of goods is considered the earliest of the following dates:

- The date on which the invoice was issued.

- The last date for issuing the invoice.

- Date of the receipt issued on advance/payment.

Time of Supply of Services

The time of supply of services is considered the earliest of the following dates:

- The date on which the invoice was issued.

- Date of the receipt issued on advance/payment.

- The date on which services were supplied (if the invoice was not issued within the prescribed time limit).

Time of Supply Under Reverse Charge

In the case of a Reverse Charge Mechanism (RCM), the time of supply to the service recipient is the earliest of the following dates:

- Date of payment.

- 30 days from the date of issuing the goods invoice (60 days for services).

As of 11/15/2017 “Date of Payment” does not apply to goods and applies only to services. Notice No. 66/2017 – Central Tax

2. Place of Supply Under GST

The role of place of supply in the GST section is very crucial. It helps determine whether the sale of goods or services carried out falls under inter-state or intra-state supply. As mentioned above, inter-state supplies attract IGST (Integrated Goods and Services Tax), while the intra-state supply attracts either CGST (Central Goods and Services Tax) or SGST (State Goods and Services Tax). Chapter 5 of the IGST Act clearly defines the place of supply under GST.

- Section 10 of the IGST Act states the necessary information about the place of supply of goods that are imported or shipped from India.

- Section 11 of the IGST Act states the necessary information about the place of supply of various goods.

- Section 12 of the IGST Act states the necessary information about the place of supply where both supplier and recipient region are within India.

- Section 12 of the IGST Act states the necessary information about the place of supply where the region of either supplier or recipient is outside India.

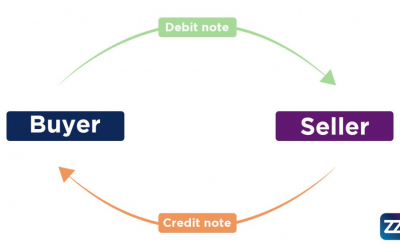

Place of Supply of Goods

Place of supply of goods usually means the place where the goods are sold or supplied; it is where the ownership of specific goods is changed in exchange for money or considerable reward. In case there is no movement of the goods, the goods’ location when delivered to the recipient is considered the place of supply. If the delivered goods require assembling and installation, the place of supply is where the installation is done.

Place of Supply of Services

In general, the place of supply of services under GST means the site where the services are sold or supplied. In case specific service is provided to an unregistered seller whose location cannot be tracked, the service provided area will be considered the place of provision for the supply of that service. The GST regime has set out some special provisions to determine the place of supply for the services mentioned below:

- Services Related to Real Estate/Immovable Properties

- Restaurant/Catering Services

- Admission to Events

- Transport of Passengers/Goods

- Telecommunications Services

- Banking/Insurance/Financial Services

Considering immovable properties, the provision for place of supply of service is the location of the property itself.

3. Value of Supply Under GST

Section 10 of CGST (Central Goods and Services Tax) Act 2017, defines the value of supply as the concept that evaluates the cost/price of the goods or services supplied. It is the final component that helps determine the applicable GST rates of an item or service. Valuation has a significant impact, as GST is collected based on the value of goods or services. Generally, under GST, for tax collection, the transaction value of a supply is taken as the bid’s actual value. However, here are some of the effective methods used to determine the value of a supply of goods/services.

- Comparison Method

- Computed Value Method

- Residual Method

Conclusion

Time, place and value of supply are the three major components of the GST regime that determine which of the three GST rates (CGST, SGST and IGST) apply to the supply. Lack of understanding might lead to the issuance of incorrect invoices that might reflect on GST return filing. What to do if you are an accounting toddler who doesn’t understand the complexities of tax calculation? Implement Imprezz invoicing and billing software to rid of the hassles of GST accounting. We offer a 14 days free trial software program for small businesses, chartered accountants, and freelancers in India. Log in today to know more!