The Goods and Services Tax (GST) e-invoice is a digitally generated invoice for the business transactions recorded on the government portal. The concept of GST e-invoice schema is expected to curb GST tax evasion. The authorities working for GST Council have officially provided a standardized digital billing system for businesses to generate e-invoices for each sale on the GST portal. Modern accounting software has adopted the new e-invoice system by aligning the data access and retrieval as per the standardized e-invoice format.

GST e-invoicing system is applicable for businesses that meet the established threshold limit, the minimum threshold notified by the government. According to the latest notifications, taxpayers and businesses with a certain threshold will receive a Unique Identification Number (UIN) each time they issue an e-invoice. It helps them match the invoices written on sales returns with that of taxes paid for verification.

Imprezz offers the best electronic billing software solution for businesses in India. The program provides seamless integration of API and import and export functions for uploading or downloading Excel sheets. It is an easy-to-use automated accounting system that comes with added value; reconciliation, e-way bills, GST return filing, reports, customizable quotation templates, consolidated electronic invoices, data archiving, etc.

Procedures for Obtaining GST E-Invoice

There are various stages involved in obtaining an e-invoice. Here’s how to create and issue e-invoices as a registered taxpayer.

Step – 1

PEPPOL (Pan-European Public Procurement On-Line) standard is an electronic data interchange protocol designed to simplify the invoicing processes involved from purchase to pay between the government and suppliers. Taxpayers must verify and ensure that their ERP system is reconfigured accordingly. It enables the service providers to integrate the updated e-invoicing standards that instill the mandatory parameters notified by the CBIC.

Step – 2

Registered taxpayers are usually provided with two basic options to generate an (Invoice Reference Number) IRN.

- Taxpayers can directly whitelist their computer’s IP address on the GST e-invoice portal for API integration or to integrate via GSP (GST Suvidha Provider).

- Taxpayers can otherwise download bulk invoicing tools that help upload invoices in a batch. It further creates a JSON file that has to be uploaded to the GST e-invoice portal to generate an IRN in bulk.

Step – 3

The next step is to create a regular e-invoice that includes all the mandatory fields. For instance, billing name, address, GSTN of the supplier, item rate, transaction value, GST rates applicable, taxable amount, etc.

Step – 4

Once taxpayers finalize one of the options mentioned above, they can create invoices in the ERP or invoicing and billing software. It is crucial to upload the invoice details with all the required fields to the (Invoice Registration Portal) IRP using JSON files. It can be done via a software service provider (either an application or GSP). The IRP is a central registrar for e-invoices and authentication. Taxpayers can also interact with IRP through SMS-based messaging and mobile apps.

Step – 5

In the next step, the IRP will validate the details uploaded by the taxpayers. Each B2B invoice is verified for duplication and generation of IRN: Supplier’s GSTIN, Invoice Number, and Fiscal Year in YYYY-YY and Document Type (INV / DN / CN).

Step – 6

The portal generates the IRN with a digital signature on the invoice and creates a QR code in the supplier’s output JSON file. In the meantime, suppliers will be informed of e-invoice generation through email (if provided in the invoice).

Step – 7

In the end, IRP sends an approved payload to the GST portal. Authenticated details will be sent to the e-way billing portal (if any). Supplier’s tax forms are automatically completed for the relevant tax period determining the tax liability.

Note: Taxpayers can continue to create invoices with their logo prints on them. The e-invoicing system doesn’t restrict businesses on logo prints; instead, it only obligates them to report invoices in the IRP in an electronic format.

How will GST E-Invoice Curb Tax Evasion?

The government has implemented the new GST system aiming to curb tax evasion. According to the new system, e-invoices must be compulsorily generated through the GST portal. It allows the tax authorities to access transactions executed in real-time quickly. Since invoices are now created before the transaction, it reduces the scope for manipulating the invoices. Thus, Input Tax Credit can only be claimed originally as ITC is combined with the production tax details. All-in-all, it becomes easier for GSTN to track fake tax credit claims.

Mandatory Fields of an E-Invoice

Taxpayers must adhere to the GST invoice rules while drafting an e-invoice. It is crucial to implement an ideal invoicing and billing software like Imprezz, that has adapted the system and policies that each industry type or sector follows in India. Some invoice details are mandatory, while the others are optional. The e-invoicing system allows freedom to choose the relevant fields to be filled in an e-invoice. Mandatory fields under e-way bills are now merged with e-invoice, such as type of secondary supply.

According to the latest announcement on e-invoice format content notified on 30th July 2020, taxpayers must focus on various gist of e-invoicing under GST.

- The e-invoice format contains 12 sections, including the mandatory and optional fields.

- It includes six annexures that consist of a total of 138 fields.

- Out of the 12 sections, five are mandatory, and 7 are optional fields.

- Two annexures are mandatory under the new GST system.

- The five mandatory fields include the necessary details, vendor’s information, recipient’s information, invoice item details, and total.

- The two mandatory annexures are the item details and document total.

Benefits of E-Invoicing under GST

The new e-invoicing system allows B2B invoices to be authenticated electronically by the GSTN. The new system ensures the standardization of invoices, and thus, ERP suppliers must update their layouts accordingly. Here are some of the crucial benefits of e-invoicing under GST.

- Simplified GST Compliance

- Real-Time Invoice Tracking

- Precision

- Easy Creation of E-way Bills

- Minimized Reconciliation Errors

- Timely Reporting of B2B Invoices

- Helps the Recipients

- Deduction in Price

- Supports Interoperability

- Abolition of Paper Invoices

- Increase in Capital Performance

- Scanning through QR Code

- Improves the Overall Business Efficiency

Drawbacks of the GST E-Invoice System

The main objective of implementing an e-invoicing system was to curb tax evasion. The new system facilitates the B2B invoices and not B2C invoices. The maximum number of frauds occurs from B2C invoices as there is no involvement of ITC. Therefore, the system should emphasize allowing customers to report incompatible invoices that help reduce tax evasion at its source.

The capacity to upload invoices is based on the data uploaded on the GSTR-1 Form during the last two years. Thus, GSTN needs to be equipped with the latest technology to minimize the downtime that adversely affects GST compliance. Despite the several updates on the GST portal, the archive option is still missing in the IRP. Taxpayers yet do not have permission to store the invoice data for more than 24 hours.

Scope of Mandatory E-Invoicing in India

In India, mandatory e-invoicing will come into force from 1st January 2021 for Indian taxpayers with an annual turnover exceeding rupees 100 crores. Taxpayers and businesses are expected to prepare quickly to take full control of solutions that facilitate the generation and issuance of e-invoices. In early October, the Finance Minister, Ajay Bhushan Pandey, announced that e-invoicing through IRP would be available for businesses and taxpayers starting from 1st January 2021, explaining the goal of making e-invoices mandatory for B2B transactions as of 1st April 2021.

The transactions must the carried out through GST e-invoices on the IRP when the government mandates the B2B e-invoices in India. The announcement was made officially on 10th November 2020 when the CBIC confirmed the businesses’ eligibility to implement e-invoice authentication from 1st January 2021. The mandate GST rule in India is currently applicable to businesses and taxpayers with an annual turnover of more than rupees 500 crores. Banks, teleservice providers, financial institutions, and armed forces are exempt from issuing e-invoices.

Conclusion

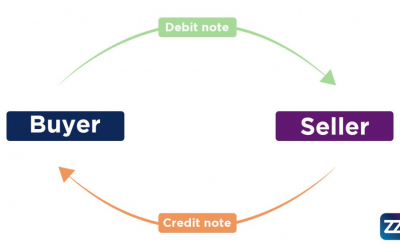

E-invoice is the exchange of an integrated electronically formatted document between a supplier and a recipient. The conventional billing processes included heavy paperwork and tedious manual data entry tasks that are intense and prone to error. E-invoicing under GST focuses on reducing the invoicing costs and processing life cycles for businesses. Before implementing an e-invoicing system for your firm, you need to make certain crucial decisions. Do you want to manage accounting tasks internally or work with a third-party e-invoicing solution provider? What e-invoicing solution best suits your business requirements?

Is your existing invoicing solution software repeatedly failing to offer the best for your business? Imprezz is the leading B2B accounting solution service, provider. The e-invoicing model offers integration that enables suppliers and customers to achieve GST compliance as per the specified e-invoicing GST laws and rules under a single platform. Process invoicing data without investing in expensive software or employee resources. We offer a 14 days free trial software program for small businesses in India. Log in to get started with the new GST electronic invoice system.